Co-working is no longer just a trend, it’s a mainstay of how startups, freelancers, and even large enterprises think about office space. But here’s the kicker: the lease structure you choose as a co-working operator can make or break your business model. Whether you sign an operating lease or a finance lease, your risk profile, cash flows, and growth potential will look dramatically different.

In this blog, we’ll break down the differences between finance and operating leases in the co-working context, unpack their impact on profitability, and explore hybrid models that many successful operators are adopting today.

What is an Operating Lease in Co-Working?

Think of an operating lease as the classic rental agreement. You, as the operator, pay rent to the landlord for using the space, but you don’t carry ownership risks.

Ownership & Risk: The landlord owns the property, carries the risks, and enjoys any long-term value appreciation.

Flexibility: Short-to-medium lease terms, often with options to renew or exit. Great for testing new markets or experimenting with demand

Cash Flow: Predictable monthly rent expense, often easier to model.

Accounting: Traditionally treated as offs-balance sheet, but under Ind-AS 116/IFRS 16, right-of-use(ROU) assets and lease liabilities are recognized.

Example: A co-working brand takes a 3-year lease on a floor in a Grade-A building, pays monthly rent, and sets it up as shared desks and private cabins. At lease end, they can renegotiate, exit, or expand.

What is a Finance Lease in Co-Working?

The coworking industry is booming globally, and India is at the forefront.

A finance lease (also called a capital lease) is closer to ownership in disguise. You’re essentially committing to use the property for most of its useful life, often with an option to buy it at the end.

Ownership & Risk: You (the lessee) take on nearly all the risks and rewards of ownership.

Commitment: Lease term usually spans most of the asset’s life (often 10-15 years)

Cash Flow: Higher fixed payments similar to an EMI, raise your breakeven.

Accounting: The leased property shows up as an asset on your balance sheet, with corresponding lease liabilities. Expenses get split into depreciation and interest.

Example: A co-working brand signs a 15-years lease on a building with buyout rights. They invest heavily in fit-outs and run it almost as if they own the property.

Key Differences Between Operating Lease and Finance Lease

| Feature | Operating Lease | Finance Lease |

| Ownership Risk | Landlord retains ownership & risk | Operator bears ownership-like risks |

| Lease Duration | Short-to-medium (3–5 years) | Long-term (≥75% of asset life) |

| Accounting Treatment | Expense / ROU asset (post-IFRS) | Capitalized as asset + liability |

| Flexibility | High (easy exit, renewals, test markets) | Low (long-term lock-in, high commitment) |

| Upside Potential | Limited (rent eats into margins) | Higher (if demand is stable & occupancy high) |

| Downside Protection | Better (lower breakeven, easier exit) | Weak (high breakeven, demand risk on operator) |

How Lease Structure Impacts Your Co-Working Business

Occupancy Risk:

Finance lease = higher breakeven, more pressure to keep desks full.

Operating lease = lower breakeven, easier to scale down.

Cash Flow:

Finance lease = higher fixed payments, less flexibility.

Operating lease = more manageable rent payments.

Scalability

Finance lease = works only when you’re confident in long-term demand.

Operating lease = perfect for rapid, experimental expansion.

Investor Optics:

Finance lease = inflates EBITDA (rent split into depreciation + interest), but increases leverage.

Operating lease = easier story for investors who value asset-light growth.

The Hybrid Middle Ground: Revenue-Share & Management Models

These hybrid approaches reduce risk, make cash flows more predictable, and encourage collaboration between landlords and operators. They are especially attractive in new or volatile markets where demand can be uncertain.

Revenue-Share with Minimum Guarantee (MG): You pay the landlord a base rent (MG) plus a percentage of revenue. Protects you in low-demand scenarios, but shares your upside when occupancy is high.

Management Agreements: Landlord funds capex, you run operations. You earn a fee + incentive based on performance. Ultra asset-light, perfect for scaling fast.

These models align landlord and operator incentives, making them attractive in volatile or emerging markets.

At SparkPlug, we’ve seen that some of the most successful co-working operators are the ones who aren’t afraid to experiment with these hybrid models. By mixing elements of revenue-share, MG, and management agreements, SparkPlug partners have unlocked growth in challenging markets, expanded into Tier 2 cities without heavy upfront investments, and built stronger, more collaborative landlord relationships. In short, the hybrid playbook is often the smartest route for ambitious, asset-light growth in co-working.

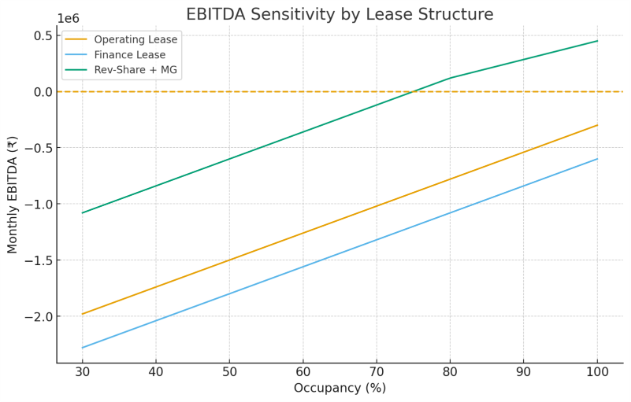

Case Example: 300-Desk Co-Working Space

Let’s crunch some numbers. Assume:

- 300 desks

- ₹10,000 per desk/month

- Variable costs: ₹2,000 per desk/month

- Fixed opex: ₹12 lakh/month

- Rent (Operating lease): ₹15 lakh/month

- Finance lease payment: ₹18 lakh/month

- Revenue-share: 25% of revenue, with ₹6 lakh MG

Results:

- Operating Lease: Needs ~112% occupancy to break even (not viable here).

- Finance Lease: Needs ~125% occupancy (worse).

- Rev-Share + MG: Breaks even at ~75% occupancy, with upside beyond 80%.

Takeaway: Asset-light, hybrid models drastically improve survival odds while still allowing upside.

How to Choose the Right Lease for Your Co-Working Strategy

Choosing the right lease is less about what looks good on paper and more about aligning with your growth stage, capital availability, and risk appetite. Let’s unpack the four key scenarios:

1. Testing a New City or Micro-Market

If you’re entering an unproven location where demand is uncertain, your priority should be flexibility. An operating lease or a revenue-share agreement allows you to test the waters without locking yourself into long-term liabilities. If occupancy doesn’t scale up, you can exit or renegotiate with relatively less financial pain.

2. Anchor Enterprise Client Signed for 5+ Years

When a large corporate has already committed to a big chunk of your inventory, a finance lease might suddenly make sense. Why? Because the client’s commitment gives you demand visibility and cushions the risk. In this case, locking into a finance lease can maximize margins over the long run, and you can design the space around that anchor tenant.

3. Expanding Aggressively with Limited Capital

If speed is your focus but you’re strapped for cash, a revenue-share model or management agreement is your best friend. These asset-light structures reduce upfront capex, share downside risk with the landlord, and allow you to plant flags in multiple markets quickly. Many Indian operators use this model to blitzscale into Tier 2 and Tier 3 cities.

4. Chasing Stable, High-Demand Locations

Prime city-center locations with consistently high demand (think Koramangala in Bangalore or BKC in Mumbai) are where finance leases shine. By locking into a long-term deal, you gain more control, can invest heavily in fit-outs, and capture the full upside of consistently high occupancy and premium pricing.

Conclusion

In co-working, your lease is more than a legal document, it’s the DNA of your business model.

- Finance lease gives control and potential margin upside but pushes risk onto you.

- Operating lease offers flexibility and lower downside but caps your upside.

- Hybrids often strike the best balance, sharing risk with landlords while preserving growth flexibility.

At SparkPlug, we believe that smart operators think as hard about lease structures as they do about design, tech, or community building. Before you sign your next lease, run the numbers, map the risks, and choose a model that fuels, not drains, your growth.

Pro Tip: Never sign a co-working lease without clarifying sub-licensing rights, break clauses, make-good obligations, and revenue-share terms. These small clauses can have massive financial impact later.